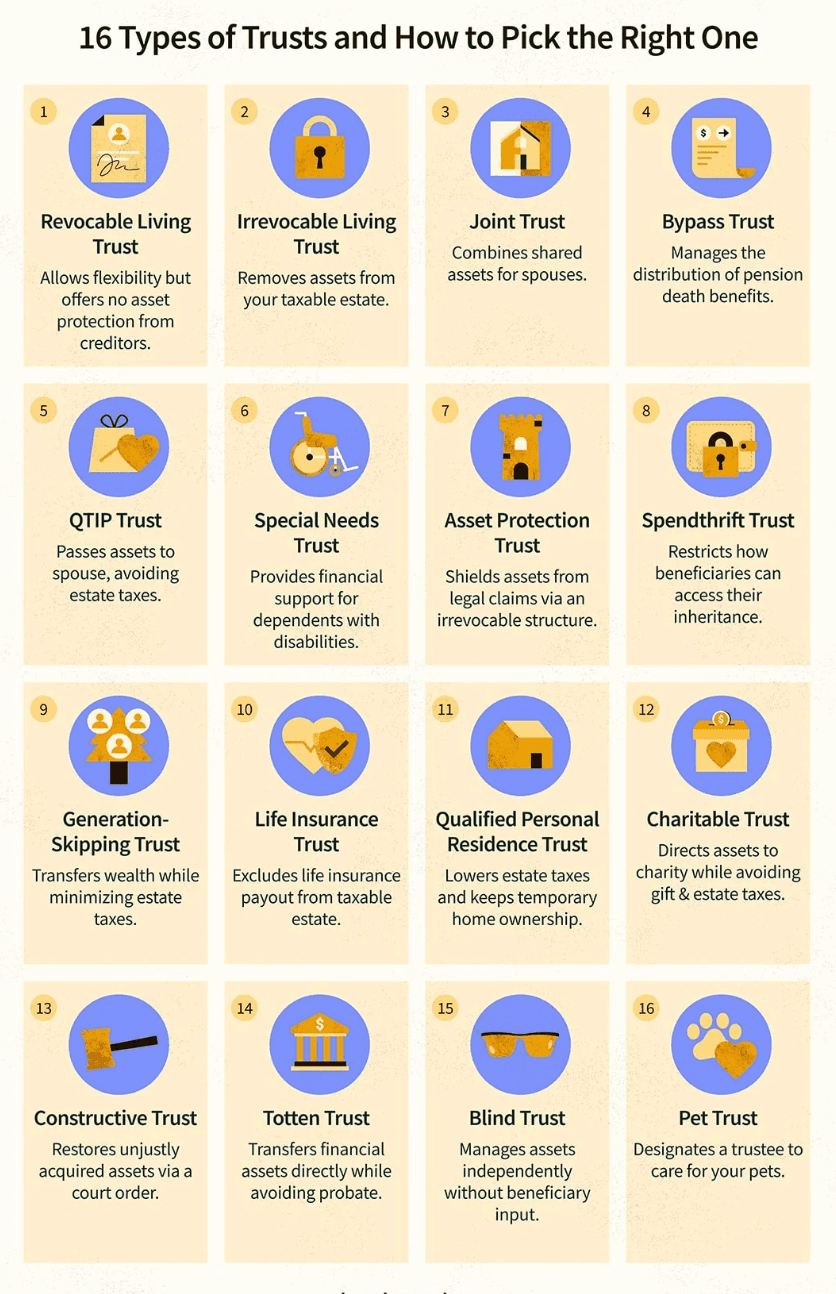

Explore a visual of 16 different types of trusts

While all trusts fit into one of two categories (revocable or irrevocable), many other types of trusts exist for more specific circumstances. Think: pet trusts and special needs trusts.

Trusts are estate planning tools used to designate assets to specific beneficiaries. They can hold a wide range of assets, including cash, real estate, stocks, businesses, and more. If a trust holds cash, that pool of cash is often considered a “trust fund,” although the definition of “trust funds” in particular is nebulous.

While some argue that the concept of trusts dates back to ancient Rome, trusts were further developed in medieval England. During the Crusades, when crusaders left for battle, they would often leave their land and other assets behind to “trusted” friends.

These days, however, there’s a common misconception that trusts are only for children of the wealthy. In reality, many personal finance experts argue that individuals of various net worths should consider establishing a trust.

Hours of research by our editors, distilled into minutes of clarity.

While all trusts fit into one of two categories (revocable or irrevocable), many other types of trusts exist for more specific circumstances. Think: pet trusts and special needs trusts.

A pet trust ensures that an animal receives financial support and care if its owner can no longer care for the pet. Some lucky dogs have inherited millions of dollars from their owners.

They’re used as a way to designate assets to beneficiaries while skirting certain taxes and maintaining one’s privacy. They can hold a wide range of assets, including cash, real estate, stocks, businesses, and more.

That’s according to data from the US Federal Reserve. There isn’t a specific net worth that can help determine whether or not someone needs a trust—but contrary to popular belief, trust funds can be great estate planning tools, even for people who aren’t ultra-wealthy.

While a trustee is supposed to be a neutral third party whom the grantor appoints to manage their trust, they can be (and often are) the same person as the beneficiary. While that seems counterintuitive, trustees have a legal obligation to manage assets impartially and in the trust’s best interest.

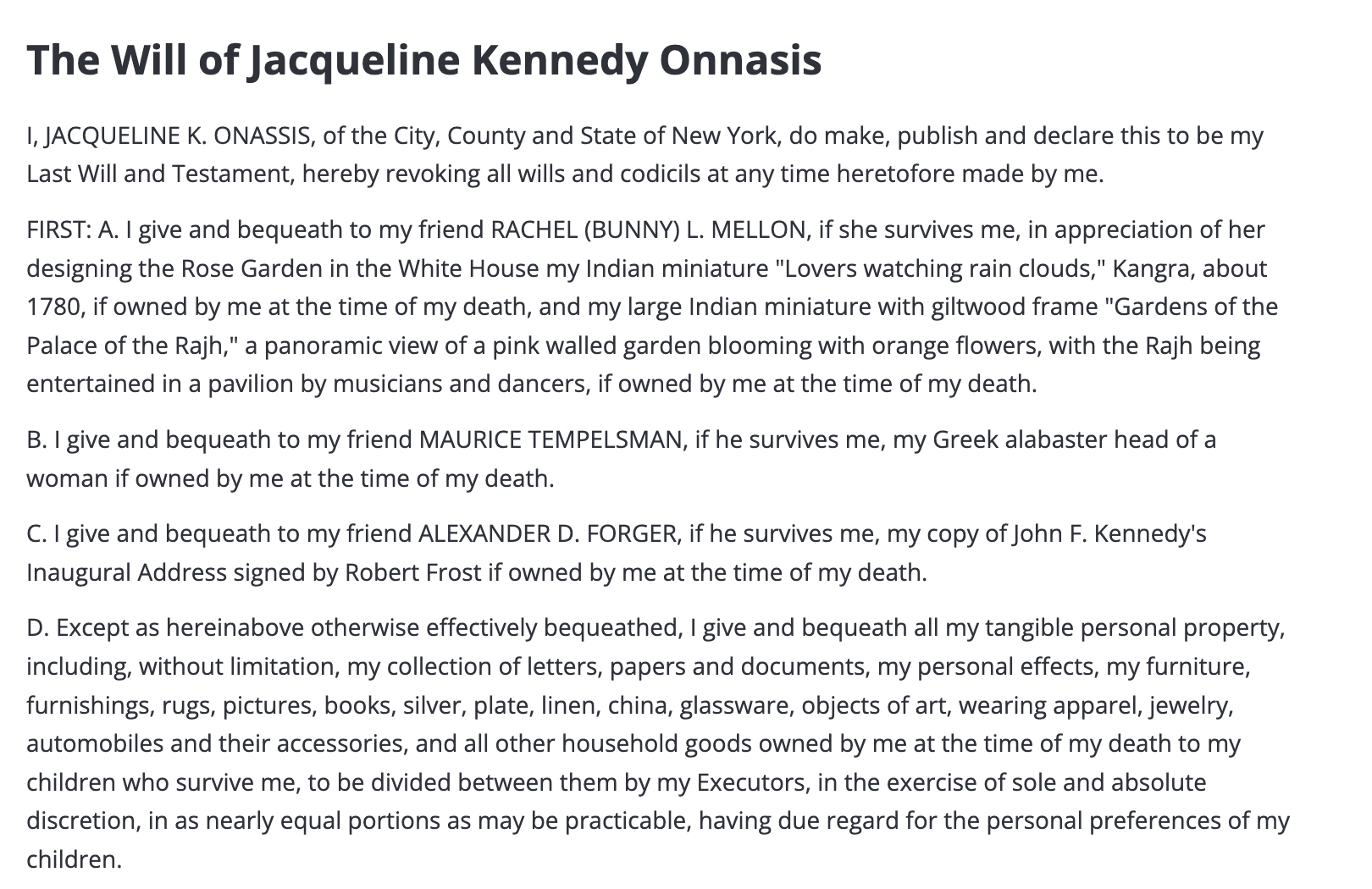

Unlike trusts, the contents of a will are public information. Former first lady Jacqueline Kennedy's will included her copy of John F. Kennedy's Inaugural Address signed by Robert Frost and other fascinating historic objects.

The executor of the will in question not only collects estate assets, but also pays outstanding taxes and more. Grantors sometimes opt for a revocable trust instead of a will so their assets avoid probate in the event of their death.

Setting up a trust often costs at least a few thousand dollars, given that the process typically requires paying for a lawyer’s time. An article lays out the step-by-step process one should follow in order to set a trust up.

Irrevocable trusts are almost impossible for the grantor to change or dissolve. With a revocable trust, the grantor can alter or dissolve the trust at any time. However, there are upsides to irrevocable trusts, too—such as the fact that they’re typically not subject to estate taxes, unlike revocable trusts.

In 2006, Amoruso founded the clothing company Nasty Gal, then later wrote a memoir called “#Girlboss” about her company’s meteoric rise. Later, she launched other ventures, including her “Business Class” business coaching series and the venture capital fund “Trust Fund.”

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.