Many of the top companies in the US by market cap began as tech startups

Combined, the top seven companies by market cap in the US as of December 2024—Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Tesla—were worth more than $16T at the time.

The term “startup” is typically used to describe private companies in their early stages of operation that focus on innovating new products or services to meet a market gap. Unlike other types of new businesses, most startups have explicit goals of scaling and growth, and often seek to disrupt an existing market or industry. To achieve this, they often must raise significant outside capital.

Uber, for example, was originally a startup designed to disrupt the taxi industry, just as Airbnb did with the vacation rental sector.

In the US, about 5.5 million new business applications were filed in 2023, and, as of 2024, there were roughly 34 million small businesses—but not all of these companies were startups.

The top seven companies in the US by market cap—Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Tesla—all began as tech startups. Combined, they are currently worth more than $20T.

Hours of research by our editors, distilled into minutes of clarity.

Combined, the top seven companies by market cap in the US as of December 2024—Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Tesla—were worth more than $16T at the time.

The definition of the word “startup” is complicated—so who better to define it than Y Combinator, perhaps the most well-known startup accelerator in the business? YC’s blog also explains how startups make money and build products.

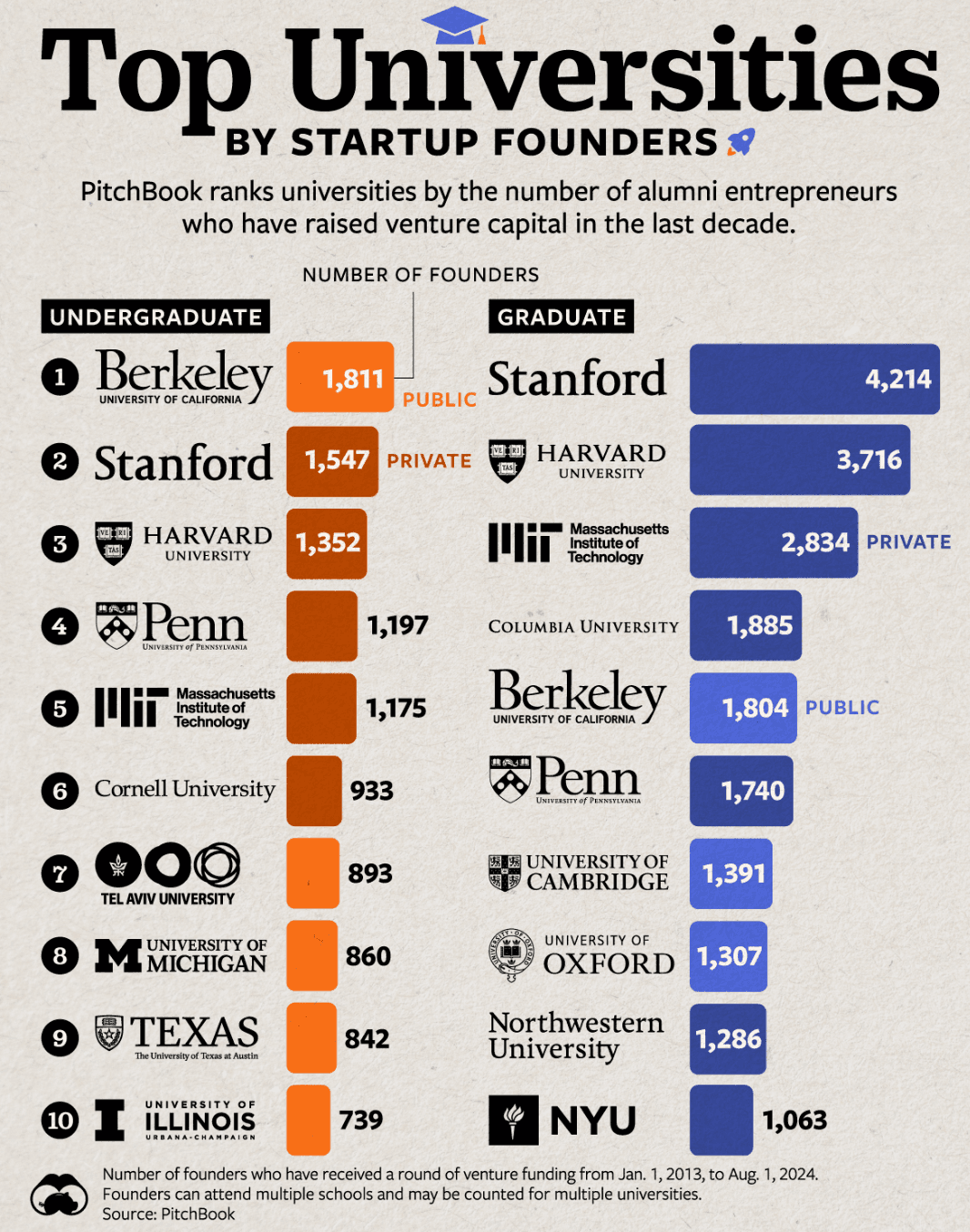

Not all startup founders are created equal. A data visualization of the universities that produce the most startup founders is based on the number of alums who have raised venture capital funding for their companies. That means these alums had to do much more than put "entrepreneur" in their LinkedIn bio to be considered startup founders.

The magazine article included what’s widely considered the first recorded use of the word “startup.” The following year, the publication Business Week went on to use the term in a piece as well.

They also differ from small businesses in that startups have a higher level of risk, may take on outside funding from venture capital firms to boost growth, and more.

WeWork has been through a lot since the office space company was founded as a startup in 2010. From its failed IPO in 2019, to the various leadership antics of its founder, Adam Neumann (some have claimed that he acted like a cult leader at times), this video tells the full story of WeWork’s growth, failures, and more.

Some experts argue that product-market fit is what separates the most successful startups from those that never get off the ground. While there isn’t an official rule book for how to optimize and test product-market fit, the CEO of email startup Superhuman has attempted to provide one with a specific four-step process.

Michael Seibel, group partner for startup incubator Y Combinator, explains how to build a minimum viable product (also known as an MVP) for any startup idea. Using real companies that experienced the Y Combinator program as examples, he walks through how to determine an MVP feature set, how to present an MVP to potential investors, and more.

In 2023, Singapore had the highest venture capital funding per capita in the world. But that doesn’t necessarily mean it’s the best place to have a startup. In 2023, PitchBook analyzed data to determine the world’s best startup city, including fundraising activity, venture capital deals, and exit value. San Francisco ranked as No. 1. See which other locales landed in the top 20 with this graphic.

When startups take on outside funding, those investments are divided into different "rounds." These rounds are catered to different stages in a startup's life cycle—a startup often needs different types of investors and amounts of funding at different stages of the business. For instance, a pre-seed investment round can include investments ranging from about $25K to $500K, whereas a Series D investment can be hundreds of millions of dollars.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.