The stock market, explained in 3 minutes

Curious about the inner workings of the stock market? 1440's got your breakdown of how it works.

The stock market consists of a set of exchanges and other venues where shares of public companies are bought and sold. The Nasdaq and the New York Stock Exchange are two of the most well-known exchanges in the US, while major exchanges also operate around the world, including in Tokyo, Shanghai, London, and São Paulo.

In the early 1600s, the Dutch East India Company spurred the creation of the first-ever stock exchange, the Amsterdam Stock Exchange (now Euronext Amsterdam). To fund its ocean voyages, the company sold shares and paid dividends to investors. In 1792, 24 stockbrokers and merchants signed the “Buttonwood Tree Agreement” that created the New York Stock Exchange.

The sentence, “I own 10 shares of Apple stock,” illustrates the difference between stocks and shares. Investors spend their careers trying to anticipate what the stock market will do next by structuring risk, using tax advantages, and undertaking due diligence. Roughly 90% of active managers of large, public funds underperform the major indexes.

Hours of research by our editors, distilled into minutes of clarity.

Curious about the inner workings of the stock market? 1440's got your breakdown of how it works.

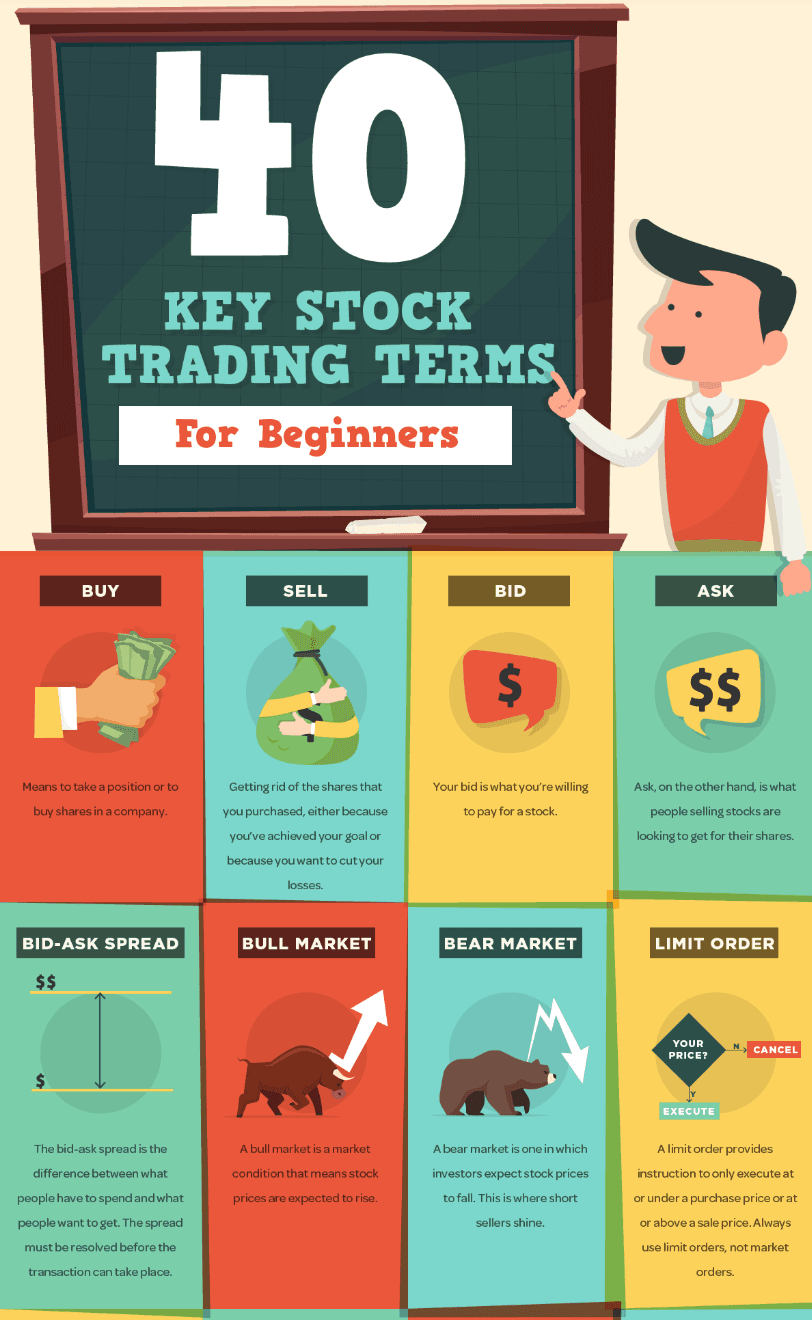

Liquidity. Forex. Capitalization. Blue chip stocks. These are just a few pieces of stock market vocabulary most people who don’t spend all day on a trading floor might not know. Thankfully, we found a fun infographic that makes it easier to learn what 40 key stock market terms mean and why each of them matters.

Totaling a market capitalization of $106T (as of 2023), this map identifies the major stock exchanges worldwide on a map, ranking them by total market value. Nearly half of that value is located in the Americas.

While the words “stock” and “share” are often used interchangeably in casual conversation, they have different meanings. For instance, "stock" is more general, whereas "share" is more precise.

The stock market has come a long way since the 1600s, when the first version of a stock exchange was created in Amsterdam. Mile markers along the way include everything from the Dow Jones Industrial Average's creation in 1896 to the stock market woes during the COVID-19 pandemic in 2020.

While the S&P 500 might yield (roughly) a 10.5% average annual return, the factors that go into that calculation are multifaceted—from how inflation impacts it, to the stocks themselves.

What is now referred to as Euronext Amsterdam got its start centuries ago, in the early 1600s. Back then, it was called the Amsterdam Stock Exchange—and it might not have existed without the Dutch East India Co.’s desire to raise funding for its seafaring ventures.

From going public with an initial public offering, to struggling with how negative news coverage impacts a stock’s value, this video lets you put yourself in the shoes of a newly public company. This makes learning about the inner workings of the stock market much easier.

After the "Barbie" movie premiered, the number of investors in Barbie parent company Mattel's stock grew more than six times larger on the investment platform Public, according to the platform's recent report. Other cultural trends have affected which stocks investors choose as well.

Only two years after that stock exchange in Philadelphia started, the largest stock exchange in the US to date was created: the New York Stock Exchange.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.