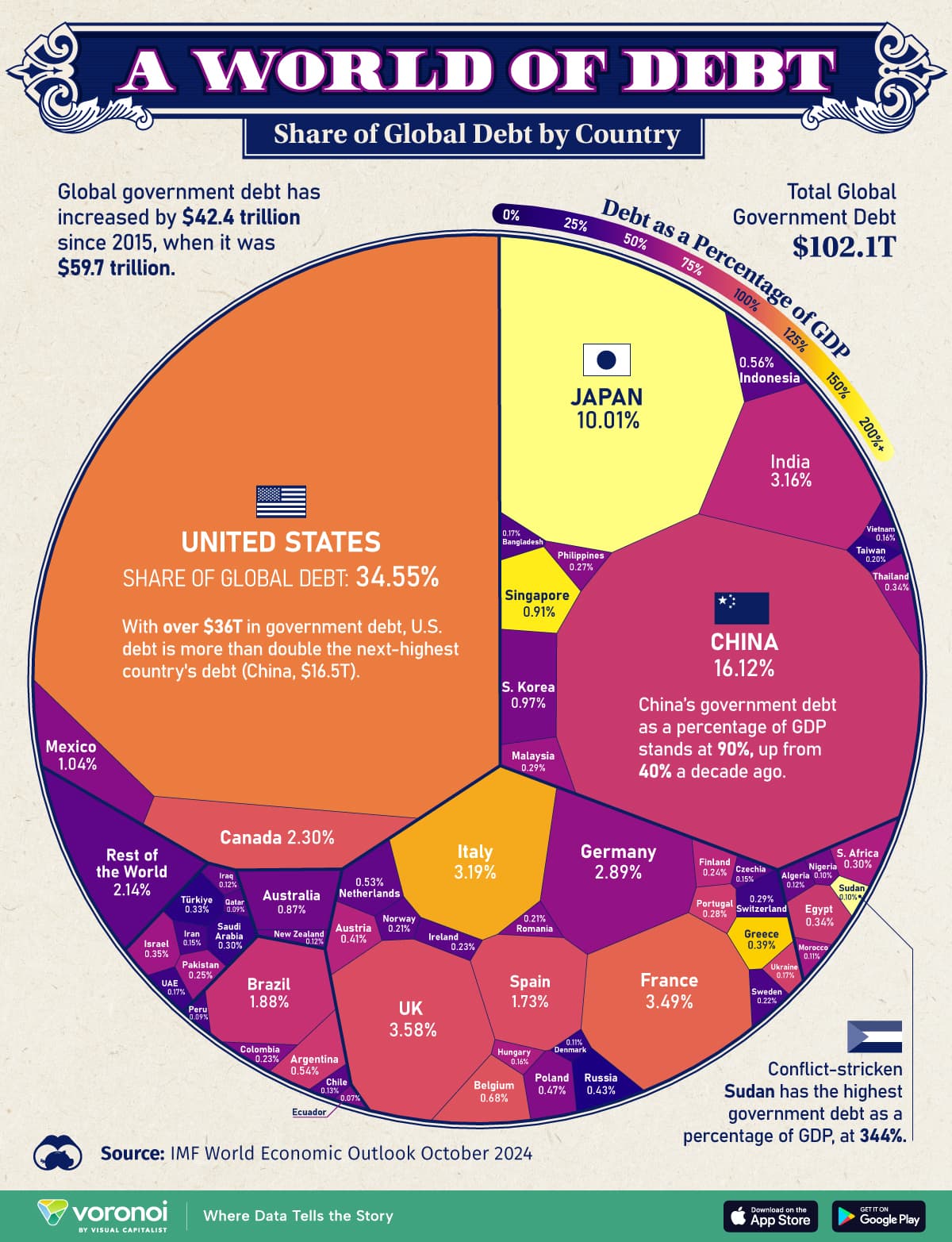

The national debt of the US has been trending upward for over a century

The national debt of the US fluctuates. A federally managed database is updated daily and shows how the debt constantly changes over a 24-hour period. It’s broken down by what the government owes individual investors (debt held by the public) and what’s due to one sector of the government by another (intragovernmental holdings).