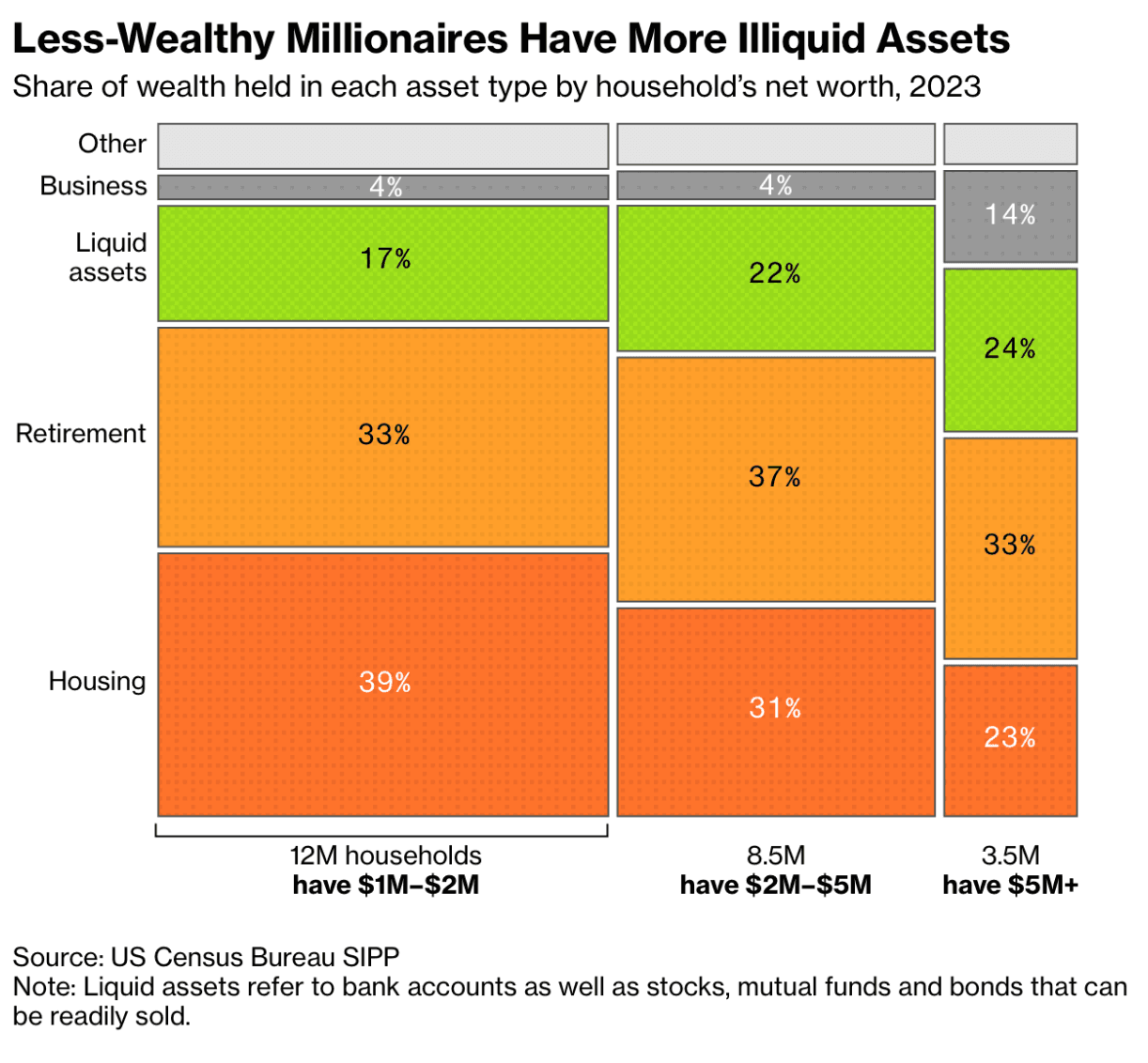

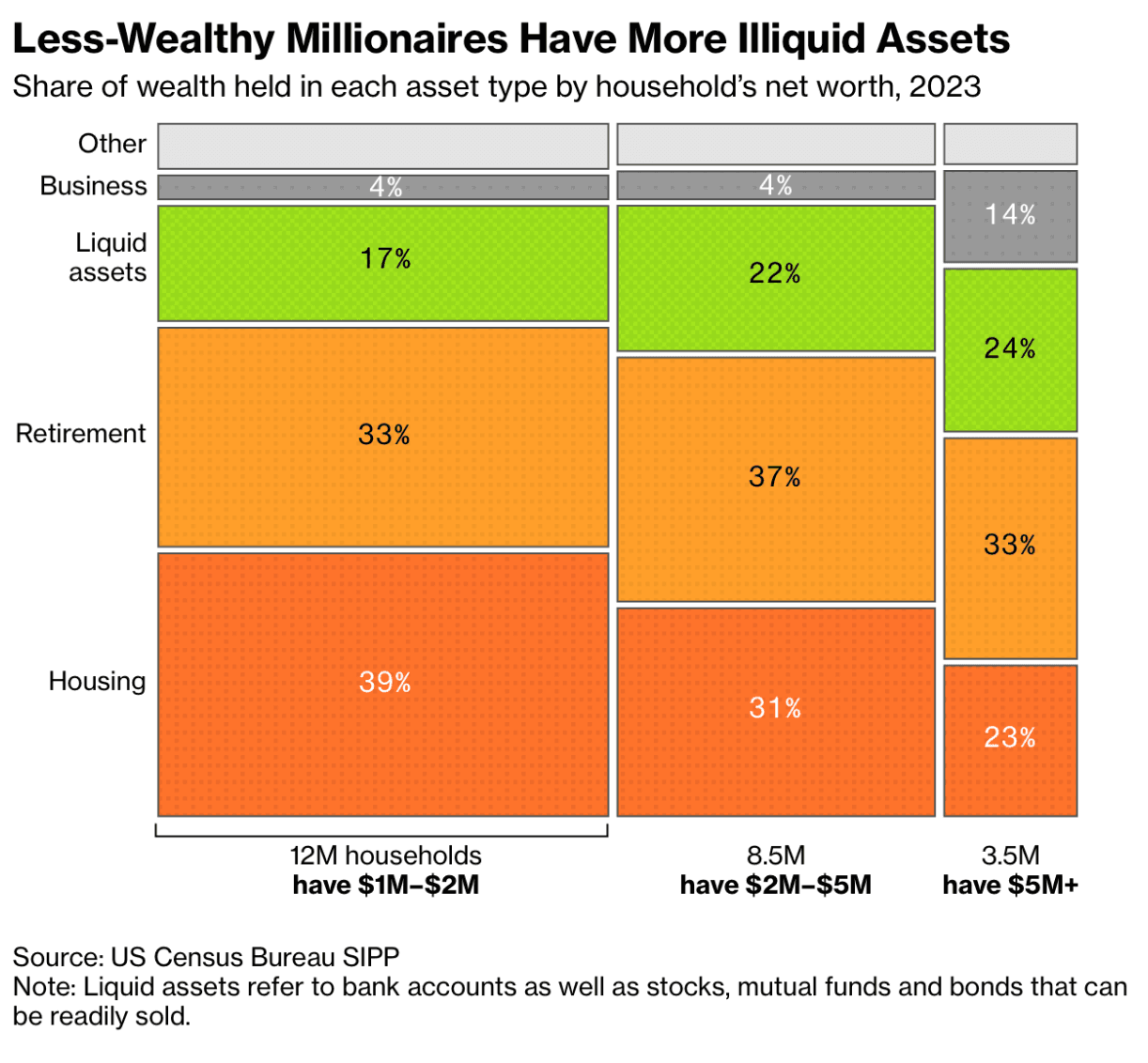

The number of illiquid millionaire households is increasing

"Illiquid" refers to the increasing number of millionaire households who have most of their net worth tied up in housing and retirement accounts.

Hours of research by our editors, distilled into minutes of clarity.

"Illiquid" refers to the increasing number of millionaire households who have most of their net worth tied up in housing and retirement accounts.

The word "mortgage" comes from medieval French, meaning "death contract"—but the modern American mortgage has a more recent and complicated history. This explainer looks at how mortgages evolved from exclusive agreements for the wealthy into a key part of homeownership today, including the impacts of New Deal policies, redlining, and the Fair Housing Act.

How much you could pay per month for a mortgage heavily depends on your financial standing, the cost of your property, and how much time you want to spend paying it off. Get a better understanding of what you can afford—and what you might be offered from a lender—with a mortgage calculator.

Debt owed on mortgages made up about 70% of US consumer debt as of 2025. Mortgage collateral ensures the lender isn’t at a complete loss if the borrower defaults. Under most mortgage contracts, the property is considered collateral under the loan. This means that if a borrower doesn’t repay the loan, then the lender can seize their property.

A mortgage is a loan used to buy property, like a house. Borrowers typically put down a percentage of the cost of the home, and the amount left over is financed through a lender, like a bank.

Borrowing money to buy a house has been a global practice since the Romans in the fifth century BCE. But before the mortgage, there was the “dead pledge,” which labeled the property as “dead” to the borrower until they paid off their loan to the lender.

The Federal National Mortgage Association is commonly called Fannie Mae, and the Federal Home Loan Mortgage Corporation is called Freddie Mac. Since Fannie Mae’s creation in 1938 and Freddie Mac’s in 1970, they’ve become staples of the housing market.

Historically, borrowing money from other people to purchase property was common until private financing companies—primarily building and loan associations—stepped in to offer mortgages to buyers.

The early 2000s were a prosperous period for the housing market, until some lending practices eventually destabilized it, leading to banks collapsing and people losing their homes.

During the Great Depression, 1,000 homes were foreclosed on per day, and half of the mortgages across the country defaulted. To address this crisis, President Franklin D. Roosevelt signed the National Housing Act. It established the Federal Housing Administration, which is still around today and helps protect lenders and buyers.

In the 1980s, 30-year fixed mortgage rates peaked just under 17%. During the COVID-19 pandemic, they were much lower, hovering around 3%.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.