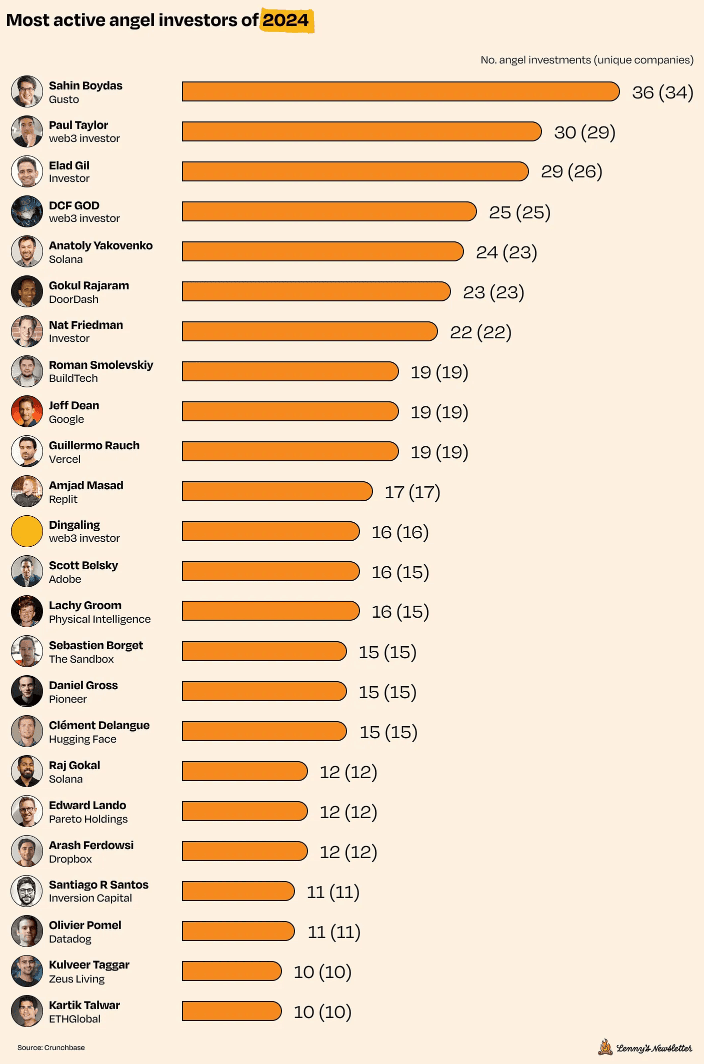

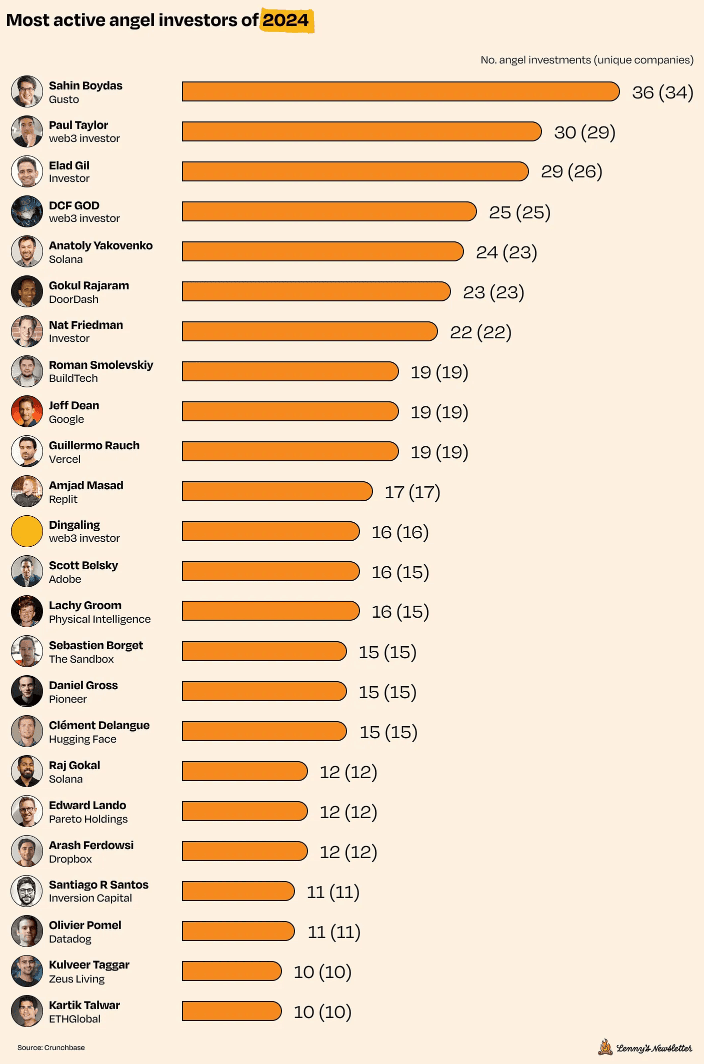

Sahin Boydas was 2024’s most active angel investor

Others who were among 2024’s top angel investors in terms of their number of angel investments in unique companies included Google’s Jeff Dean, Solana’s Anatoly Yakovenko, and more.

Hours of research by our editors, distilled into minutes of clarity.

Others who were among 2024’s top angel investors in terms of their number of angel investments in unique companies included Google’s Jeff Dean, Solana’s Anatoly Yakovenko, and more.

Entrepreneur Shaan Puri shares how seven strangers acted as Google’s earliest angel investors. The first gave Google $100K without even putting his equity agreement in writing. The investors on “Shark Tank” use their personal funds to support startups, but they’re often more predatory about terms than typical angels.

Angel investors and venture capitalists both invest in startups, but they differ in a few key ways. Angel investors typically invest earlier and in a smaller amount.

When startups take on outside funding, those investments are divided into different "rounds." These rounds are catered to different stages in a startup's life cycle—a startup often needs different types of investors and amounts of funding at different stages of the business. For instance, a pre-seed investment round can include investments ranging from about $25K to $500K, whereas a Series D investment can be hundreds of millions of dollars.

Angel investor Naval Ravikant explains what it takes to be successful in his field, from building an authentic brand to developing the judgment to choose which startups to back.

Angel investors fund startups at an early stage, at which time a company’s success is less assured. In exchange, they often ask for a significant equity stake.

The first so-called angel investors funded theatrical productions. Now, angels invest in startups at an early stage, hoping their investment will pay off in the future.

AngelList was created to connect startups and angel investors. It’s evolved since its 2010 founding and has been used by companies like Uber and OpenSea.

Cyan Banister has invested in more than 100 companies, building a reputation in the angel-investing world for her unorthodox approach.

Statistics about the angel investing market show that billions are spent funding early-stage startups each year. Companies with more angel interest had higher success rates.

Angel investors leverage their high net worths to fund seed-stage startups. While they could see high returns, investing in such an early company is a risk.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.