Sears used to sell entire DIY houses in its catalog

From 1908 through the 1940s, Sears sold DIY house kits starting at $600. An estimated 100,000 homes were built, but fewer than 5,000 have been identified today.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.

Hours of research by our editors, distilled into minutes of clarity.

From 1908 through the 1940s, Sears sold DIY house kits starting at $600. An estimated 100,000 homes were built, but fewer than 5,000 have been identified today.

No institution wields more power in US finance than the Federal Reserve—but opinion polls indicate that most Americans don't know what it does. Curious about the country's central bank? 1440's got your breakdown of how the Federal Reserve works.

Americans owe more than $1T to credit card companies. And with rising interest rates that prevent cardholders from paying down debt (not to mention the rising cost of living), that number is likely to keep growing. A podcast episode explains how the US got here, and what policymakers and individuals can do about it.

The US has the largest national debt and one of the highest debt-to-GDP ratios. These vitals have long been considered a sign of poor fiscal health, but economists are beginning to shift their attention to interest rates to evaluate national debt.

From a young age, John D. Rockefeller knew he was interested in business. He worked as a bookkeeper and sold candy prior to starting the business empire that would help cement the Rockefeller name in history: Standard Oil.

It first offered shares to the public in the 1600s on the Amsterdam Stock Exchange to help finance its passages. The Dutch East India Co. succeeded in part due to its monopolistic hold over the East Indies at the time.

The 1920s in the US "roared" with rapid economic growth after the conclusion of World War I. But in October 1929, the bubbly stock markets crashed dramatically, plunging the nation into the decadelong Great Depression.

This milestone requires plenty of preparation, starting with the SEC's S-1 registration, revealing key details about the company's finances and strategy. Investment bankers set valuations, secure long-term investors, and finalize share pricing before the public launch. IPOs provide companies with significant capital, but also demand transparency and invite public scrutiny.

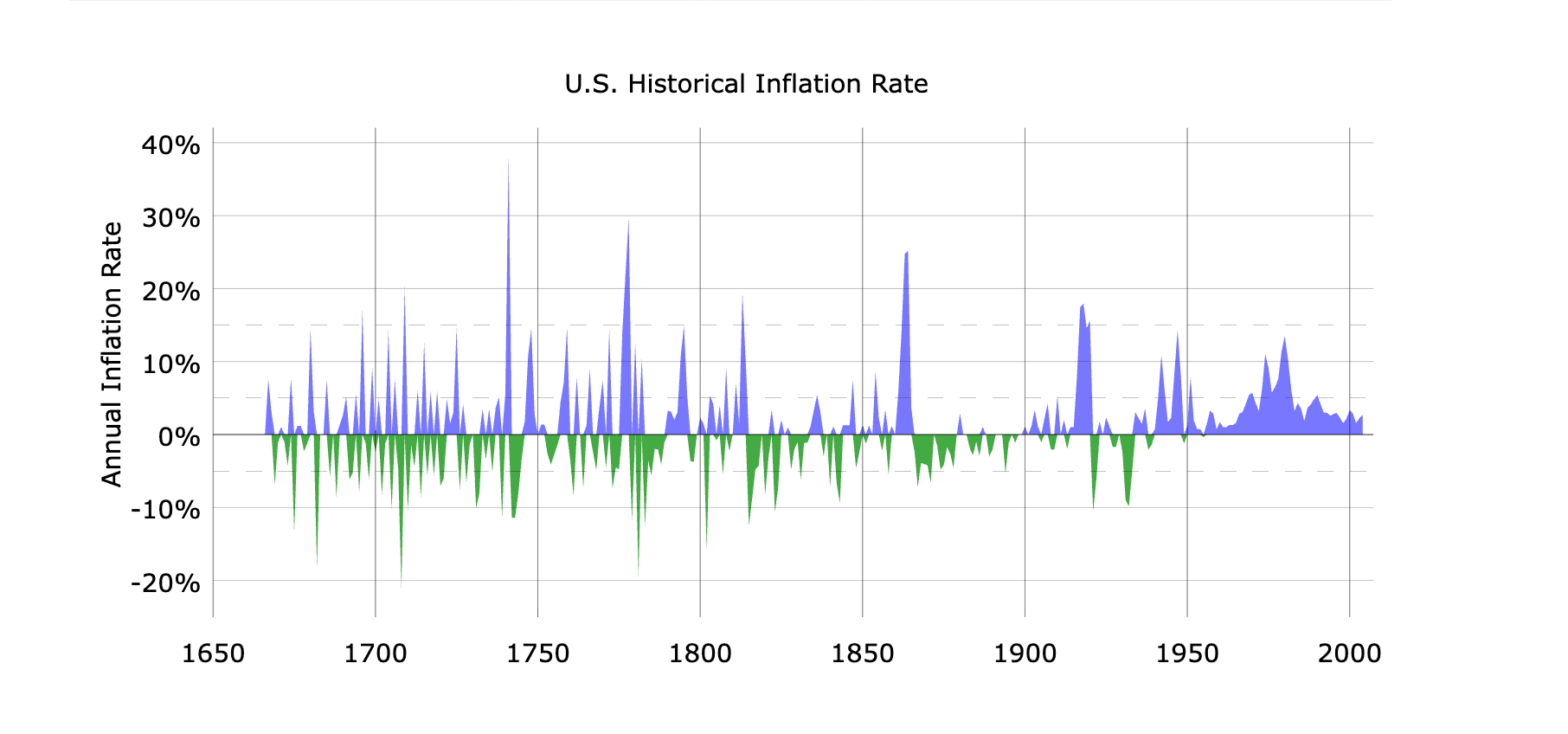

This was just after the Revolutionary War. Both World Wars also brought double-digit inflation. It's worth noting that exact inflation rates in early America are difficult to calculate precisely.

In New York City's Financial District, there's a bronze statue of a bull that attracts tourists from all over the world. But how did it get there, and what is it about the statue that makes people line up for photographs, day after day? Journalist PJ Vogt dives into the Charging Bull statue's origin story in a podcast episode (warning: some mature language).

Hedge funds often operate on a "2 and 20" model: Investors pay fund managers a 2% management fee, and the hedge fund keeps 20% of their profits. (The 2% is imposed annually, irrespective of performance.) Hedge funds are known for chasing big returns—and taking big risks to get them. This explainer not only breaks down how they work in detail, but also the strategy first introduced in 1949 that still shapes hedge fund investing today.