Privacy concerns in the credit scoring system

Because credit scores use a lot of personal information (such as whether or not someone makes credit card payments on time), some worry their privacy is being compromised in the data collection process.

Hours of research by our editors, distilled into minutes of clarity.

Because credit scores use a lot of personal information (such as whether or not someone makes credit card payments on time), some worry their privacy is being compromised in the data collection process.

Although today’s credit scoring system is much more objective than, say, the credit reporting system of the 1700s, some argue there’s still room for improvement. Specifically, some argue that the current system is still discriminatory.

Factoring rental payments into credit scores is just one proposed change some have suggested making to today’s credit scoring system to cater the system to renters as well as homeowners.

Businesses have credit scores the same way individuals do—with a few key differences. For one thing, business credit scores range from 0 to 100 instead of 300 to 850, and are based on factors such as bankruptcy and bill-paying habits.

If you move outside the US, you won’t get to take your credit score with you. Credit scoring systems work differently in other countries. In the UK, for instance, being registered to vote improves your credit score.

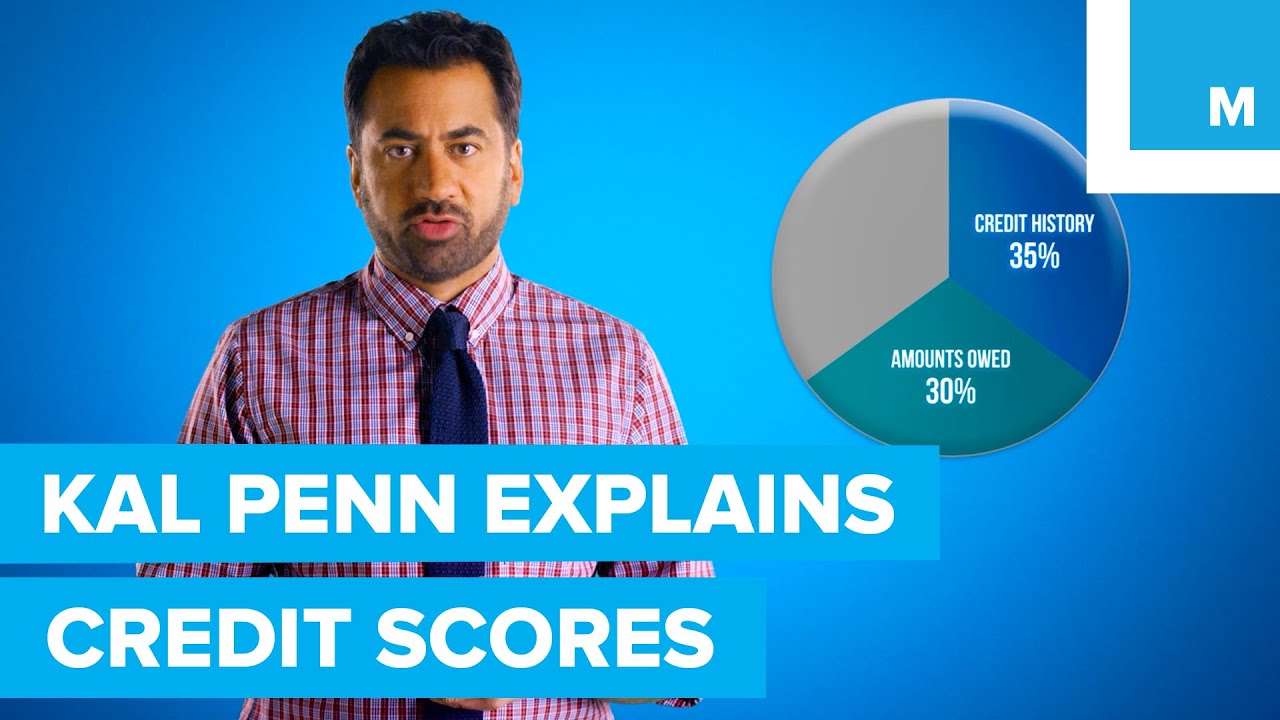

The modern iteration of credit scores hasn’t been around for that long—it was invented just a few decades ago, in 1989. This video outlines how the credit scoring system has evolved and become more complex since then. Plus, it explains what your credit score actually means, what factors impact your score, and more. Watch it here.

Kal Penn, the actor who played Kumar in the “Harold and Kumar” films and appeared in shows like “How I Met Your Mother” and “House,” just so happens to know a thing or two about how the credit scoring system works in the US.

While the three main credit bureaus and the credit scoring companies aren’t government entities, they are subject to certain US government regulations, such as the Fair Credit Reporting Act.

VantageScores are sometimes lower than FICO scores because the algorithms that calculate the two scores weigh the factors that influence them differently. For instance, VantageScores typically weigh payment history more heavily than FICO scores.

The three major credit bureaus introduced the VantageScore credit score in 2006 as a competitor to FICO. It’s calculated slightly differently from a FICO score, though just like the FICO score, it’s widely used by lenders.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.