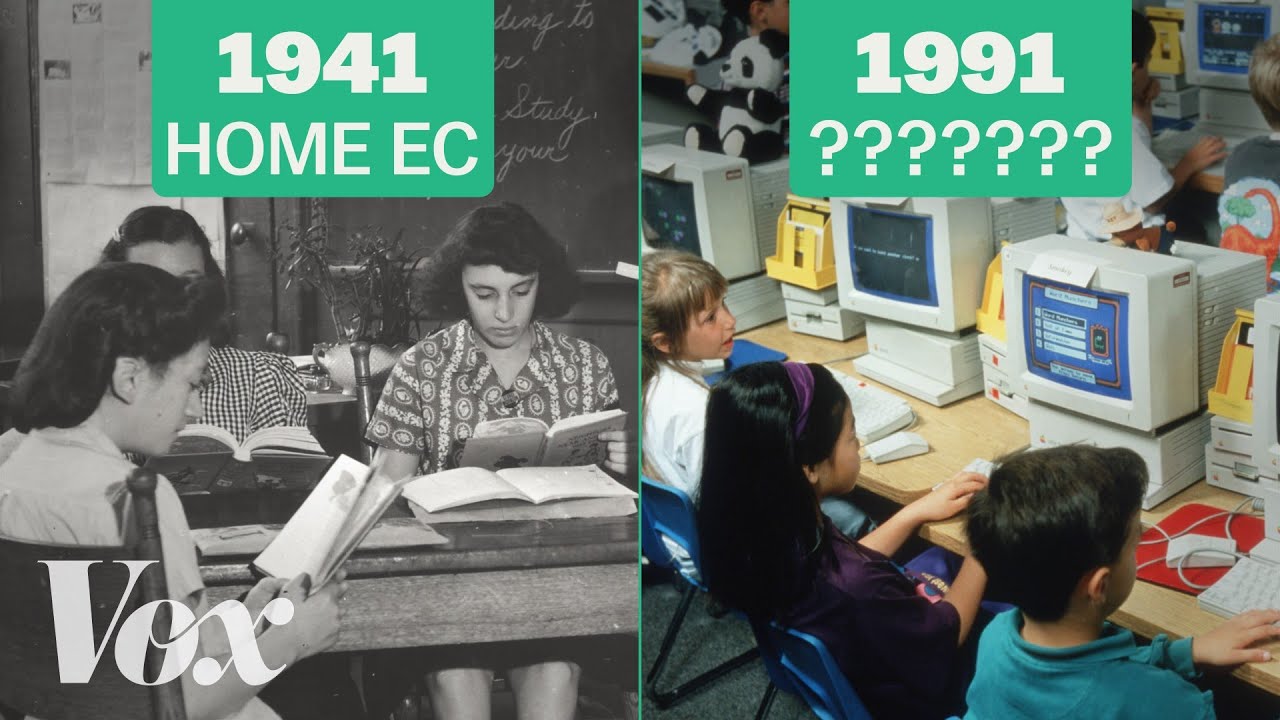

Why financial literacy education in the US sucks

If you don't remember learning anything about basic financial literacy in school, you're not alone—that's the common sentiment among those who have passed through the American school system. This video explains the history of financial education in the US and points out what can be done in the future to make the financial lessons children learn in school stick with them past recess. Watch it here.