As of 2022, the US accounted for nearly one-fifth of global oil production

By 2022, the U.S. had cemented its position as the world’s top oil producer with close to 18 million barrels per day. This eclipsed Saudi Arabia and Russia.

Oil markets are a complex global system of producing, distributing, trading, and pricing petroleum products used to make diesel, jet fuel, solvents, and more.

Hours of research by our editors, distilled into minutes of clarity.

By 2022, the U.S. had cemented its position as the world’s top oil producer with close to 18 million barrels per day. This eclipsed Saudi Arabia and Russia.

Specifically, a country’s “spare capacity” signifies the difference between its maximum sustainable oil production and its current output. OPEC member countries hold nearly all of the world’s spare oil production capacity. Historically speaking, Saudi Arabia has been the country with the largest spare capacity.

Oil spills from oil tankers—which can have a sharp, short-term impact on oil prices—have become increasingly rare over the decades in part because of stricter regulations.

There are three different geographical classifications used: Brent, West Texas Intermediate, and Dubai. The three types differ in terms of typical refinery uses, density, sulfur content, and suitability for financial benchmarking. For instance, Brent, from the North Sea, is traders’ go-to benchmark in part because it’s easily shipped, politically stable, and used to price most internationally sold crude.

Coal and gas are second and third, respectively, in terms of where the bulk of the world’s energy consumption stems from. These interactive charts can help you visualize where the world sources the most of its energy.

China is pushing to reduce its reliance on US oil to limit geopolitical vulnerabilities. It’s rapidly becoming the world’s renewable energy superpower.

More than half of the US’s oil is exported as the country produces mainly light, sweet crude but has many refineries that handle heavy, sour types.

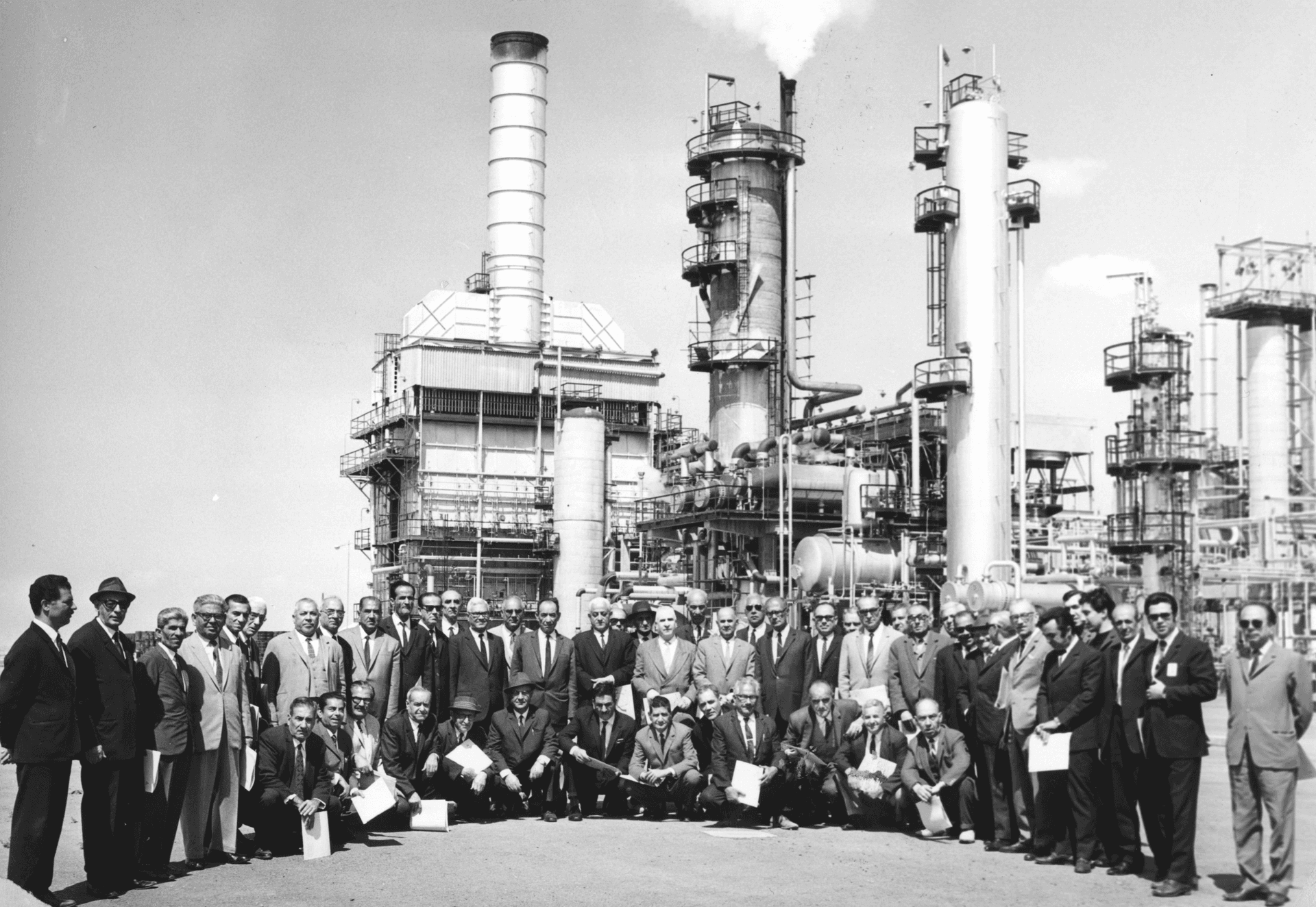

Widespread strikes in Iran’s oil sector during the 1978-79 revolution slashed production and triggered panic buying, flooding oil markets with fear.

Commodities traders look at all of these things as assets, placing short-, medium-, and long-term wagers on how much each is really worth.

This episode of The Rest Is History podcast traces oil’s pivotal role—from fueling industrial growth to steering imperial power. It also examines how access to oil shaped US politics, World War II, and sparked the creation of OPEC following the Suez Crisis.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.