The history of the IRS

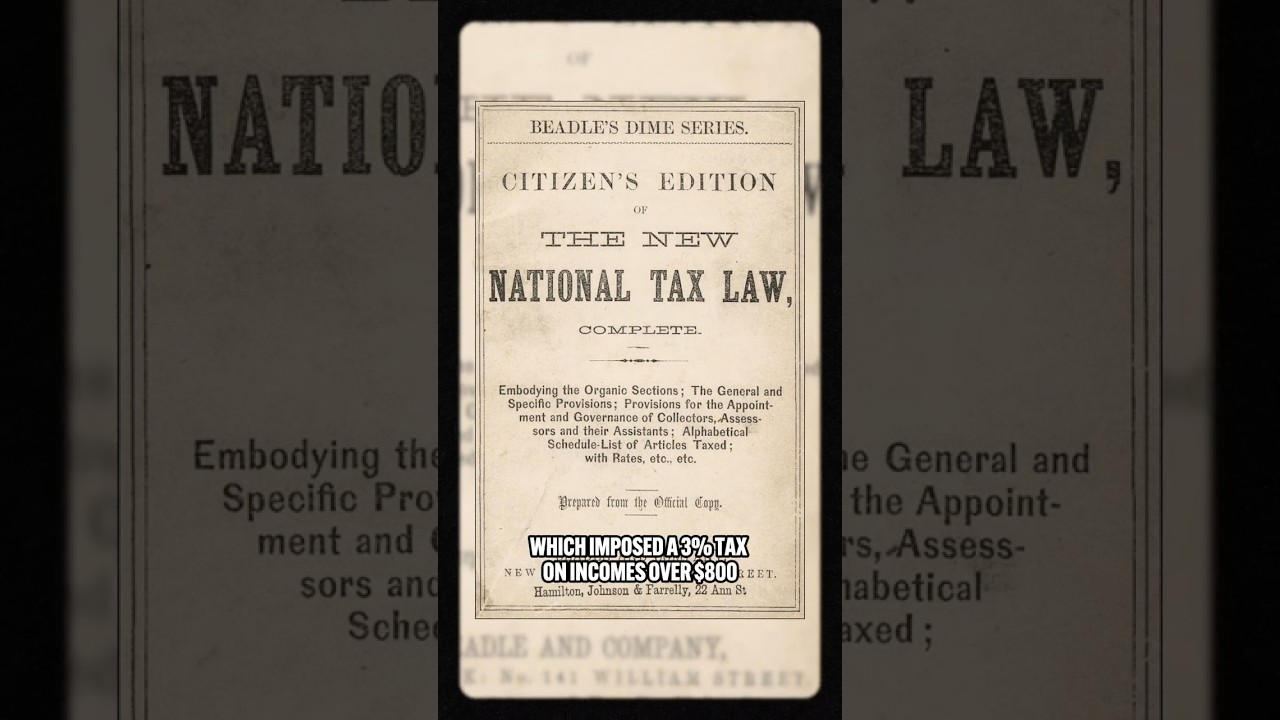

This podcast episode takes a lighthearted dive into the history of the IRS, from when the agency was founded and called the Bureau of Internal Revenue, to that one time it had to enforce a national ban on alcohol. Want to learn more? Listen to the podcast episode.