The fintech industry was worth roughly $340B as of 2025

Venture capitalists have been bullish on the industry’s future in recent years, too. Some estimate that global investment in fintech increased by 12,000% between 2008 and 2020.

From the tap-to-pay credit card system you use to buy your morning coffee, to the budgeting app that helps you determine whether you should’ve made that coffee at home instead, “fintech” is a broad term that stands for “financial technology” and refers to technological innovations in the financial services sector.

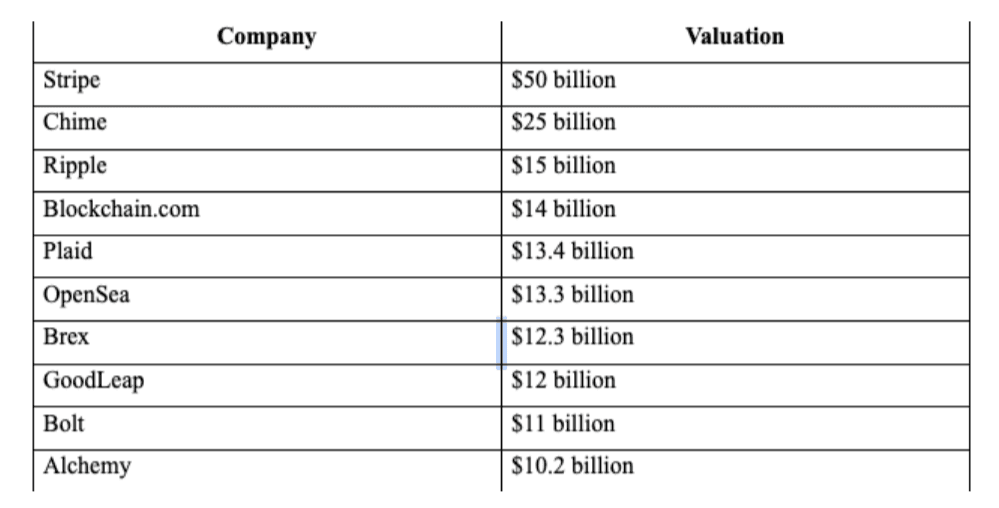

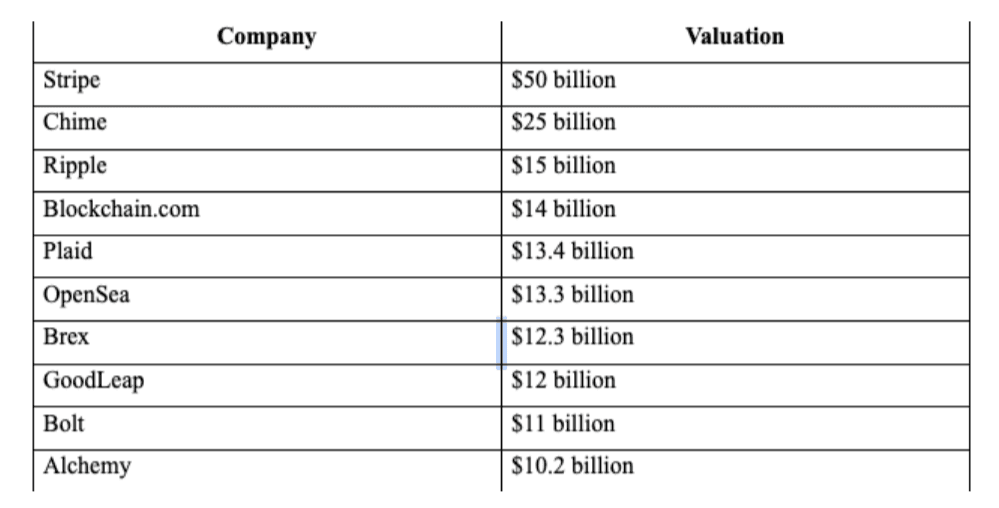

The roughly $340B fintech industry encompasses everything from mobile banking apps and robo-advisers to digital payment software. Examples include buy-now, pay-later apps like Klarna, payment processing technologies for businesses like Stripe, cryptocurrency innovations like crypto exchange Coinbase, and peer-to-peer payment services such as Venmo and PayPal.

But despite the industry’s breadth, fintech companies all have something in common: They aim to make various aspects of financial transactions more efficient and user-friendly.

The global fintech industry is growing quickly—it currently employs roughly 300,000 people, and is projected to be worth about $1T by 2032.

Hours of research by our editors, distilled into minutes of clarity.

Venture capitalists have been bullish on the industry’s future in recent years, too. Some estimate that global investment in fintech increased by 12,000% between 2008 and 2020.

Most of the industry's prominent players were created since 2010, and are still in a growth phase. These institutions have broadly disrupted traditional banking and have pushed physical banking locations toward obsolescence.

By the year 2002, PayPal went public for the first time—but that was far from the end of its business story. eBay later bought PayPal, then eventually spun it off. PayPal IPO’d for a second time in 2015.

Founded in 1982, E-Trade was the first-ever online brokerage, pioneering a method of investing that is common today. Its story is part of a timeline that the New York Times put together of key moments in early fintech history.

As a result, some banks worry they could be losing ground to the tech company. As consumers continue to use Apple Pay instead of pulling out their physical debit card to pay for everyday items, some banks are fighting back in the digital wallet war.

Specifically, the first ATM (which stands for “automatic teller machine”) made its debut at a Barclays bank in London. A timeline of ATM history can help illustrate and visualize other key events in ATM history.

The buy now, pay later industry allows consumers to buy something immediately and pay in installments without the need for applications or credit scores associated with credit cards—and fintech companies Affirm, Klarna and Afterpay are leading the charge by targeting young adults.

In 2024, a banking middleman called Synapse declared bankruptcy. Unfortunately, it also locked roughly 100,000 Americans out of their own money, which prompted a class action lawsuit.

An electronic funds transfer is the transfering of money from one bank account to another via computer-based systems. When it was first introduced, it was revolutionary. A video from 1980 aimed to explain the value of electronic funds transfer to consumers at the time.

It had significant impacts on just about every industry, including finance. Specifically, the transatlantic cable made it so that real-time financial transactions could take place across the Atlantic, and allowed for much faster sharing of information that increased global market accuracy.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.