Credit scores seriously suffer when individuals file for bankruptcy, and there’s no easy fix

Those who file for Chapter 7 must wait 10 years before the bankruptcy is removed from their credit report. For Chapter 13, the wait time is seven years.

Nearly 500,000 bankruptcies are filed each year in the United States. For these businesses—including everyday individuals, local governments, and farms and fisheries—bankruptcy can provide a way to tackle significant debt. It’s a legal process that allows debtors to negotiate and repay money owed. For some, it’s a way to get out of debt entirely.

Hours of research by our editors, distilled into minutes of clarity.

Those who file for Chapter 7 must wait 10 years before the bankruptcy is removed from their credit report. For Chapter 13, the wait time is seven years.

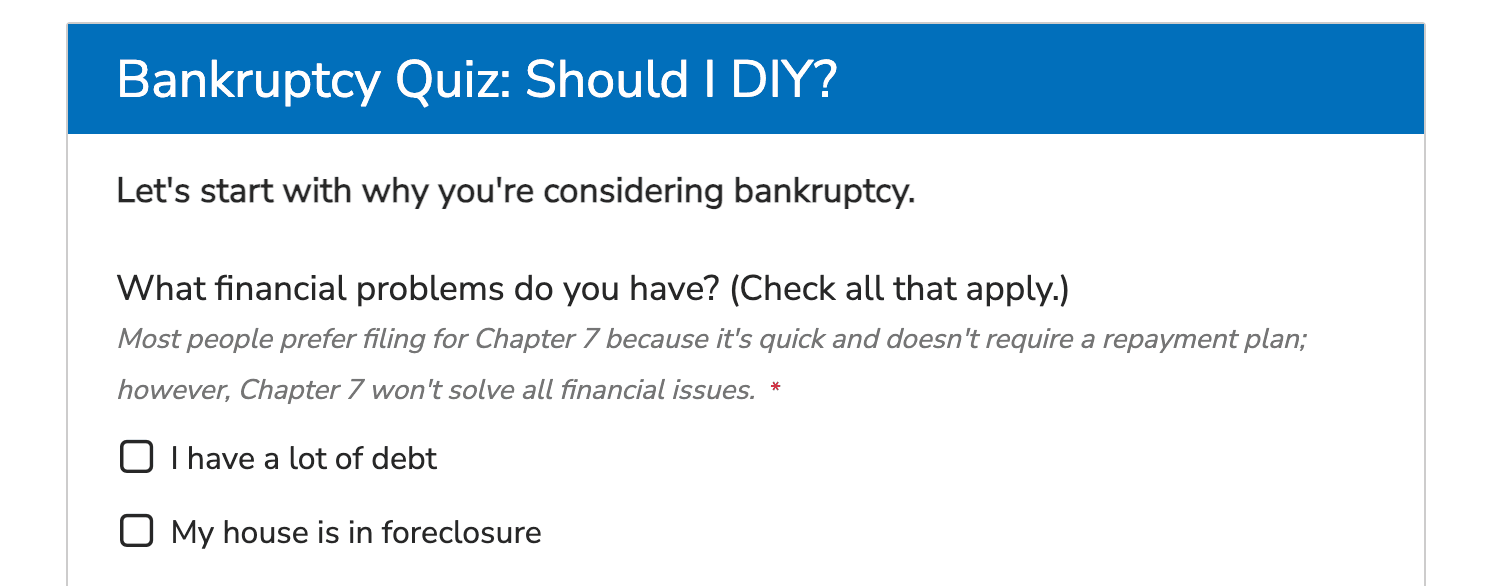

If a debtor is considering filing for Chapter 7 bankruptcy, it may be tempting to take a do-it-yourself approach to avoid attorney or preparer fees. However, experts caution that this could come back to bite filers. A quiz can help would-be filers explore whether their cases are complex enough to necessitate a lawyer.

However, the bankruptcy process does not apply to several types of common debt, including money owed toward child support or alimony payments. Most debtors also do not qualify for relief from student loan payments.

Publicly traded companies don’t file for bankruptcy out of nowhere—there are typically warning signs in a stock’s performance, quarterly earnings calls, and US Securities and Exchange Commission filings.

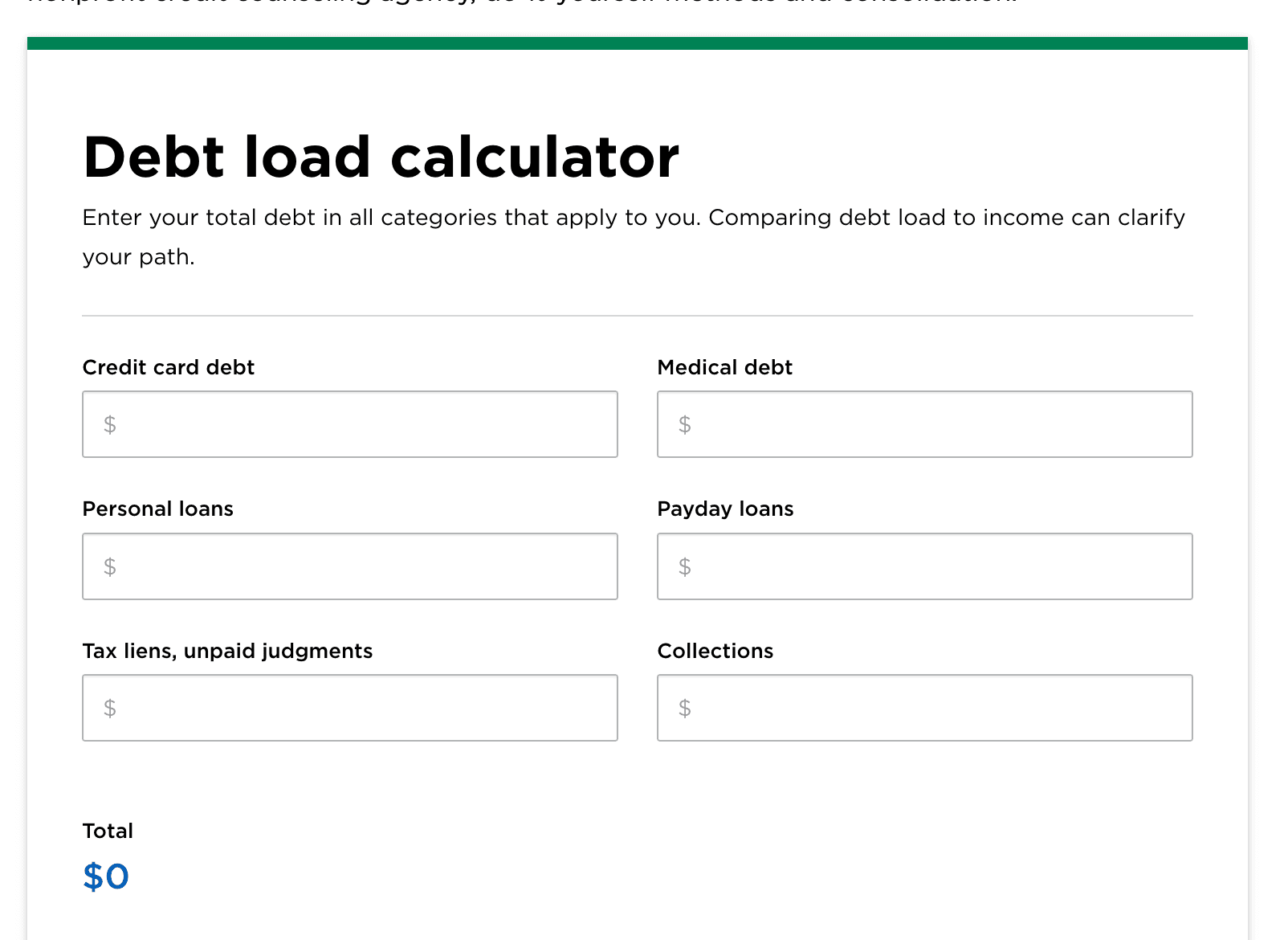

About 77% of American households had some debt at the end of 2023. However, when debt becomes crushing, it's time to consider a management plan or a bankruptcy filing. This calculator helps explore whether debt is manageable based on inputs like medical debt, payday loans, and gross annual income.

Although it's designed for lawyers, the tool is able to help everyday browsers synthesize important cases and point users to relevant documents about them. One sample using it asks Chatlaw to explain the significance of a recent case and then to define relevant terminology.

The technical term for what happens when a court removes a debtor’s obligation to repay money owed is “discharge.” An “automatic stay” is what goes into place once a filing occurs to prevent a debtor from facing lawsuits, evictions, and other negative consequences until the process wraps up.

For years before that filing, the restaurant group had been operated by two different companies: one owned by private equity, and the other that includes the original founders.

The Sears story starts with railroad worker Richard Sears purchasing a declined shipment of watches for a discounted price. An interactive historical timeline chronicles the history of Sears from then onwards.

Between competition from online retailers such as Shein and Temu, and too many physical stores for today's retail climate, Claire's has had a difficult time modernizing.

The United States is home to more than 33 million businesses, the vast majority of which are small businesses, with millions being created (and others closing shop) every year. These businesses often rely on loans, provide the goods and services that keep the economy flowing, and sometimes even grow large enough to enter public markets or provide private investment opportunities. Explore key topics central to business and finance, from the role of the Federal Reserve to how initial public offerings work, how millions of American students finance higher education, and more.